On June 26, 2025, President Bola Ahmed Tinubu signed four transformative tax reform bills into law, collectively referred to as the Nigeria Tax Reform Acts. These include the Nigeria Tax Act (NTA), Nigeria Tax Administration Act (NTAA), Nigeria Revenue Service Act (NRSA), and Joint Revenue Board Act (JRBA). Effective from January 1, 2026, these reforms overhaul Nigeria’s tax system, aiming to simplify compliance, enhance revenue generation, and create a business-friendly environment while protecting low-income earners. For HR managers, these changes significantly impact payroll management, employee tax liabilities, benefits structuring, and compliance obligations.

Source: OECD Revenue

This report provides a comprehensive analysis of the reforms’ implications for organisations’ workforces and tax liabilities, with a focus on equipping HR managers with actionable insights. Key changes include personal income tax (PIT) exemptions for low-income earners, revised tax rates, the introduction of rent relief, and increased compliance requirements through digital reporting. HR managers must adapt payroll systems, communicate changes to employees, and align with the new Nigeria Revenue Service (NRS) to ensure compliance and optimise workforce strategies.

—

Key Provisions of the Nigerian Tax Reform Acts Relevant to HR Managers

The four Tax Reform Acts introduce changes that directly affect employee tax obligations and organisational responsibilities. Below is a detailed breakdown of the most relevant provisions for HR managers:

1. Nigeria Tax Act (NTA) 2025

The NTA consolidates over 20 tax-related laws, including the Personal Income Tax Act, Companies Income Tax Act, and Value Added Tax Act, into a single framework. Key changes for HR managers include:

– Personal Income Tax (PIT) Exemptions and Progressive Rates:

– Employees earning ₦800,000 or less annually are exempt from PIT, providing relief for low-income workers. Those earning up to ₦1,000,000 annually can claim a rent relief of up to ₦200,000, reducing taxable income to qualify for the exemption.

– Progressive PIT rates apply to higher earners, with rates up to 25% for incomes exceeding certain thresholds. This ensures higher earners contribute more while protecting low-income workers.

– Compensation for loss of office or employment, libel, slander, or personal injury up to ₦50 million is exempt from Capital Gains Tax (CGT), an increase from the previous ₦10 million threshold. Amounts exceeding ₦50 million are taxed at the CIT rate (27.5% in 2025, 25% from 2026).

– Rent Relief Replacing Consolidated Relief Allowance: The Consolidated Relief Allowance has been replaced with a rent relief mechanism, allowing employees to deduct up to ₦200,000 from taxable income if their annual income is ₦1,000,000 or less. This aims to ease the cost-of-living burden for low-income employees.

– Presumptive Taxation for the Informal Sector: For employees in the informal sector or freelancers, the NTA introduces presumptive taxation, estimating tax liability based on turnover or other proxies when financial records are inadequate. HR managers hiring consultants or gig workers must ensure proper tax registration and compliance.

– Taxation of Remote and Digital Income: Income earned by remote workers, freelancers, or employees working for foreign companies from Nigeria must be declared in Naira equivalent and taxed under PIT rates. This clarifies tax obligations for the growing gig economy.

– Withholding Tax (WHT) on Certain Payments: Payments to entertainers, directors, consultants, and athletes now attract a 5% final WHT for non-resident providers, impacting organisations hiring international talent.

2. Nigeria Tax Administration Act (NTAA) 2025

The NTAA establishes uniform rules for tax administration across federal, state, and local governments, reducing bureaucratic complexity. For HR managers:

– Streamlined Compliance:

– The NTAA eliminates conflicting tax interpretations, simplifying payroll tax deductions and remittances for organisations operating across multiple states.

– Deductions (e.g., rent relief) must be claimed in writing in a prescribed form, increasing administrative responsibility for HR teams to ensure employees submit claims correctly.

– Digital Reporting Requirements: The transition to the Nigeria Revenue Service (NRS) emphasises digital tools for real-time tax reporting and audits, requiring HR systems to integrate with NRS platforms.

3. Nigeria Revenue Service Act (NRSA) 2025

The NRSA replaces the Federal Inland Revenue Service (FIRS) with the Nigeria Revenue Service (NRS), a more autonomous, technology-driven agency. For HR managers, this means enhanced enforcement. The NRS will use data-driven audits to enforce compliance, increasing scrutiny on payroll tax deductions and remittances. HR managers must ensure accurate records to avoid penalties.

4. Joint Revenue Board Act (JRBA) 2025

The JRBA establishes the Joint Revenue Board, Tax Appeal Tribunal, and Tax Ombudsman to improve coordination and dispute resolution. For HR managers, the Tax Ombudsman and Tax Appeal Tribunal provide mechanisms for resolving tax disputes, such as incorrect PAYE deductions or employee tax assessments, offering a fairer process for organisations and employees.

—

Impact on Organisations’ Workforces and Tax Liabilities

The Tax Reform Acts introduce both opportunities and challenges for organisations’ workforces and tax liabilities. Below is an analysis of their impact on employee tax liabilities:

– Increased Disposable Income for Low-Income Earners: Employees earning ₦800,000 or less annually (or up to ₦1,000,000 with rent relief) are exempt from PIT, increasing their take-home pay. This can boost employee morale and reduce financial stress, particularly for entry-level or junior staff. HR managers should communicate these exemptions clearly to employees to manage expectations and highlight benefits in compensation packages.

– Progressive Taxation for High Earners: Higher-income employees face progressive PIT rates up to 25%, increasing their tax liabilities. This may require HR managers to adjust salary structures or offer tax-efficient benefits, such as equity-based compensation, to retain talent. The increased CGT rate (aligned with CIT at 27.5% in 2025, 25% from 2026) on compensation for loss of office exceeding ₦50 million impacts severance packages, requiring careful planning for executive terminations.

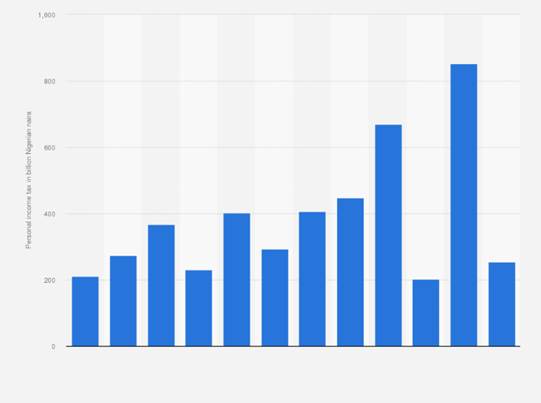

Source: Statista (Personal Income Tax Revenue, 2010-2021)

– Remote and Freelance Workers: The clarification of remote income taxation ensures freelancers and remote employees working for foreign companies are taxed in Nigeria. HR managers must ensure these workers are registered with state tax authorities and comply with PIT obligations, particularly for organisations with hybrid or remote workforces.

—

Practical Steps for HR Managers

To navigate the new tax landscape effectively, HR managers should take the following steps:

1. Conduct a Workforce Impact Assessment: Analyse how PIT exemptions, progressive rates, and rent relief affect employees across income levels. Identify which employees qualify for exemptions and communicate these benefits clearly. Also review equity-based compensation plans (e.g., stock options) for tax efficiency, especially given the increased CGT rate for large companies.

2. Update Payroll Systems: Integrate payroll software with NRS digital platforms for real-time reporting and compliance with e-invoicing requirements. Ensure systems account for PIT exemptions, rent relief claims, and WHT on payments to consultants or non-residents.

3. Train HR and Finance Teams: Engage Proten International to organise training sessions on the Tax Reform Acts, focusing on payroll compliance, deduction claims, and remote income taxation. Collaborate with finance teams to confirm small business exemptions and optimise VAT credits for employee-related expenses.

4. Communicate with Employees: Develop clear communication materials explaining PIT exemptions, rent relief, and remote income rules. Use town halls, emails, or HR portals to educate employees. Highlight tax-efficient benefits (e.g., health insurance, educational allowances) to enhance retention and morale.

5. Engage Tax Professionals: Consult tax advisors to navigate complex areas, such as CGT on severance packages or WHT for international consultants.

6. Monitor Implementation and Compliance: Establish a change management plan to monitor the transition to the new tax regime, ensuring compliance by January 1, 2026.

—

Conclusion

The Nigeria Tax Reform Acts of 2025 represent a new step towards a modern, equitable, and efficient tax system. For HR managers, the reforms introduce significant changes to employee tax liabilities, payroll management, and compliance obligations. By leveraging PIT exemptions, rent relief, and VAT credits, organisations can enhance employee benefits and reduce tax burdens, particularly for low-income workers. However, adapting to digital reporting, ensuring accurate payroll deductions, and managing increased CGT rates require proactive planning and investment.

HR managers play a crucial role in navigating this transition by updating systems, training staff, and communicating changes clearly and effectively. By aligning with the new tax regime, organisations can not only ensure compliance but also position themselves as attractive employers in a competitive labour market. The success of these reforms depends on transparent enforcement, public trust, and collaboration between HR, finance, and tax professionals.

To ensure your organisation thrives in Nigeria’s evolving regulatory and business landscape, engage Proten International to deliver tailored training for your HR managers and finance professionals. Our expert-led programmes cover the 2025 Tax Reform Acts, guiding you through payroll compliance, employee tax liabilities, and digital reporting requirements. Beyond tax, we offer comprehensive training in leadership development, performance management, and workforce optimisation to empower your teams. Contact Proten International today.