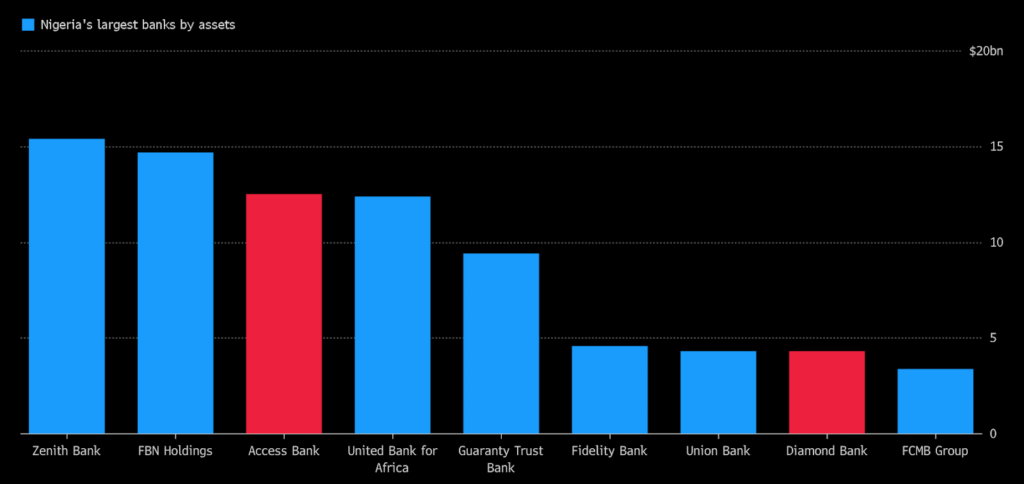

In April 2019, Access Bank Plc, a leading Nigerian multinational commercial bank, completed its merger with Diamond Bank Plc, creating Africa’s largest retail bank by customer base, with over 42 million customers and assets exceeding N6.1 trillion (approximately $16.7 billion at the time), according to the report by Euromoney. The merger was a strategic move to bolster Access Bank’s position in Nigeria’s competitive banking sector, capitalise on Diamond Bank’s robust digital and retail banking expertise, and expand its pan-African presence.

Source: Bloomberg

However, integrating two large institutions with distinct cultures, systems, and workforces presented significant challenges. Initial misalignment led to duplicated efforts, operational inefficiencies, and customer dissatisfaction. To address these issues, Access Bank launched the “One Access” initiative, a comprehensive strategy to align legacy teams, optimise the workforce, and drive post-merger synergy. This case study examines the initiatives that contributed to workforce optimisation and their impact on Access Bank’s operational efficiency and competitive positioning.

The Access Bank–Diamond Bank Merger

Announced in December 2018 and finalised on 1 April 2019, the merger was a market-driven transaction, unlike previous CBN-imposed consolidations in Nigeria’s banking sector. Access Bank, known for its strong corporate and investment banking franchise, acquired Diamond Bank, a tier-2 lender with a significant retail customer base and advanced digital banking capabilities. The merger aimed to create a financial institution with unmatched scale, serving 29 million customers across 12 countries, supported by 3,100 ATMs and nearly 32,000 point-of-sale (POS) terminals.

The strategic rationale was clear: combining Access Bank’s risk management and capital management expertise with Diamond Bank’s technology-led retail platform would position the merged entity as a pan-African financial services leader.

Post-Merger Challenges

The merger brought together two institutions with distinct organisational cultures, operational systems, and workforce dynamics. Access Bank employed approximately 28,000 staff, while Diamond Bank contributed a significant retail-focused workforce. Key challenges included:

- Cultural Misalignment: Access Bank’s corporate banking culture emphasised risk management and structured processes, while Diamond Bank’s retail focus prioritised agility and customer-centric innovation. This led to friction among legacy teams.

- Duplicated Efforts: Overlapping roles in areas such as loan processing, customer service, and IT support caused inefficiencies and delayed decision-making.

- System Incompatibilities: Disparate IT systems and CRM platforms hindered seamless data integration, affecting customer experience.

- Customer Complaints: Delays in loan approvals and inconsistent service delivery led to a spike in customer dissatisfaction, threatening retention rates.

- Workforce Anxiety: Uncertainty about job security and role changes created low morale among employees, particularly from Diamond Bank.

The “One Access” Initiative: A Strategy for Alignment

To address these challenges, Access Bank’s leadership, led by the late Group Managing Director, Herbert Wigwe, introduced the “One Access” initiative. This programme aimed to unify the workforce, streamline operations, and enhance customer experience through three core pillars: shared KPIs, regular interdepartmental workshops, and a unified CRM system. The initiative was designed to foster collaboration, eliminate silos, and align legacy teams towards common goals.

1. Shared Key Performance Indicators (KPIs)

To align individual and departmental goals with overarching organisational priorities, Access Bank implemented a unified performance management framework centered around shared key performance indicators (KPIs). These KPIs focused on core areas such as operational efficiency, customer satisfaction, and financial performance. By rolling out these KPIs across all levels—from senior management to frontline staff—the bank ensured a high level of accountability and transparency throughout the organisation.

To support this initiative, performance dashboards were introduced to enable real-time tracking of progress, complemented by quarterly reviews to recalibrate targets in response to market dynamics. Incentives such as bonuses and recognition programmes were tied to collective KPI achievements, fostering collaboration across the legacy Access and Diamond Bank teams.

This approach yielded tangible results: role clarity reduced duplication of effort, enabling loan processing teams to standardise procedures and cut approval times by 40%. The emphasis on customer-centric KPIs led to a 15% rise in customer retention, while employee engagement surveys showed a 20% improvement in perceptions of fairness and clarity around performance expectations.

2. Regular Interdepartmental Workshops

To break down silos and foster cross-functional collaboration, Access Bank initiated a series of monthly interdepartmental workshops designed to bring together teams from retail banking, corporate banking, IT, and customer service. These sessions, facilitated by external consultants and senior leaders, focused on team-building, cultural integration, and collaborative problem-solving. Through role-playing exercises that mirrored real-world challenges—such as addressing complex customer inquiries or managing IT integration issues—employees gained a deeper understanding of each other’s functions and pain points.

Feedback gathered from the workshops was used to refine internal processes, including streamlining account opening procedures and enhancing digital banking features. The impact was significant: the workshops helped bridge cultural gaps, fostering a unified “One Access” identity. Employees reported a 25% increase in trust and collaboration across departments. Cross-functional exchanges also led to product innovations, such as the integration of Diamond Bank’s mobile banking capabilities into Access Bank’s platform.

3. Unified Customer Relationship Management (CRM) System

To streamline customer data management and enhance service delivery, Access Bank invested in a unified Customer Relationship Management (CRM) system that integrated data from both the legacy Access and Diamond Bank platforms. This replaced previously fragmented systems that had caused delays, inconsistencies, and customer frustration. The new CRM provided a comprehensive 360-degree view of customer interactions, enabling more personalised service and faster query resolution. Staff across departments received extensive training on the platform, supported by dedicated IT teams to ensure a smooth transition.

The implementation delivered substantial results. Customer query resolution times dropped by 35% as staff could now access real-time data without toggling between systems. Loan processing became significantly more efficient, with automated workflows reducing approval timelines from an average of 10 days to just 6.

Outcomes and Impact

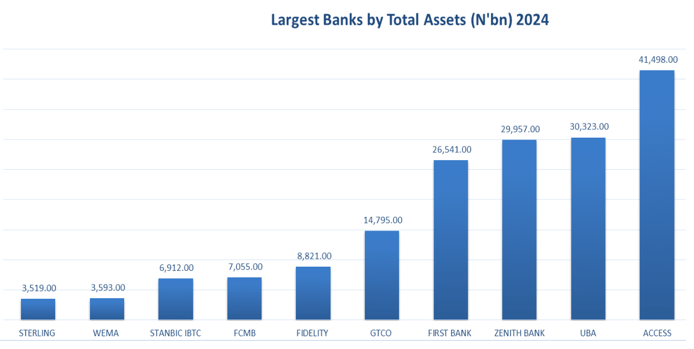

Source: MoneyCentral

The “One Access” initiative transformed Access Bank’s post-merger integration, delivering measurable outcomes across operational, financial, and customer metrics:

- Operational Efficiency: According to BusinessDay, loan processing times improved by 40%, and account opening procedures were streamlined, reducing customer wait times by 30%.

- Customer Retention: Enhanced service delivery and faster query resolution led to a 15% increase in customer retention, with the customer base growing to 42 million by 2021, according to a report by the Daily Post.

- Financial Performance: Studies confirmed a significant improvement in return on equity (ROE) and return on assets (ROA) post-merger, driven by cost synergies (N30 billion annually) and revenue growth from expanded product offerings. (FUDMA)

- Workforce Optimisation: Employee morale improved, with a 20% reduction in turnover rates among legacy Diamond Bank staff. Engagement surveys highlighted increased job satisfaction due to clearer roles and collaborative opportunities.

- Competitive Positioning: Access Bank solidified its position as Nigeria’s largest bank by assets and Africa’s largest by customer base, surpassing competitors like Zenith Bank (14.9% market share vs. Access Bank’s 15.9%).

These outcomes were particularly significant given Nigeria’s challenging economic environment, including naira volatility and regulatory pressures. The merger’s success also positioned Access Bank to pursue further expansion, including acquisitions in Kenya, Mozambique, and South Africa.

Lessons Learned

The Access Bank–Diamond Bank merger offers valuable lessons for organisations seeking alignment and synergy in a fragmented workforce:

- Alignment is Critical for Synergy: The “One Access” initiative demonstrated that aligning teams through shared goals, collaborative platforms, and integrated systems can turn a fragmented workforce into a cohesive unit. Shared KPIs ensured that individual efforts contributed to organisational success.

- Cultural Integration Requires Deliberate Effort: Interdepartmental workshops helped to bridge cultural divides, highlighting the importance of fostering trust and collaboration within diverse teams.

- Technology as an Enabler: A unified CRM system was pivotal in streamlining operations and enhancing customer experience, underscoring the role of technology in seamless and efficient processes and operations.

- Leadership Commitment Drives Change: The active involvement of Herbert Wigwe and senior management in championing the “One Access” initiative ensured its success, reinforcing the need for strong leadership in complex integrations.

About Proten International

Proten International is a leading international human resource and management consulting firm which provides a range of advisory and transformation solutions. Our focus is to align every organisation’s activities relating to people. Process, and technology closely with its business strategy and vision.

Over the years, we have worked with a long list of clients across Africa and Europe. Whether your organisation is looking to undertake enterprise transformation, organisational design and structuring, performance management, HR audit, L&D strategy design, or organisational culture definition and alignment, Proten International is the partner for you. Contact us today to book your consultation.