Nigeria’s current economic reality, marked by inflation, high unemployment, and rising poverty levels, has placed immense pressure on employees. This economic hardship has significantly impacted mental health, leading to increased cases of anxiety, depression, and burnout. Employees bear the brunt of rising living costs, job insecurity, and financial instability, which directly affect workplace productivity, engagement, and overall well-being.

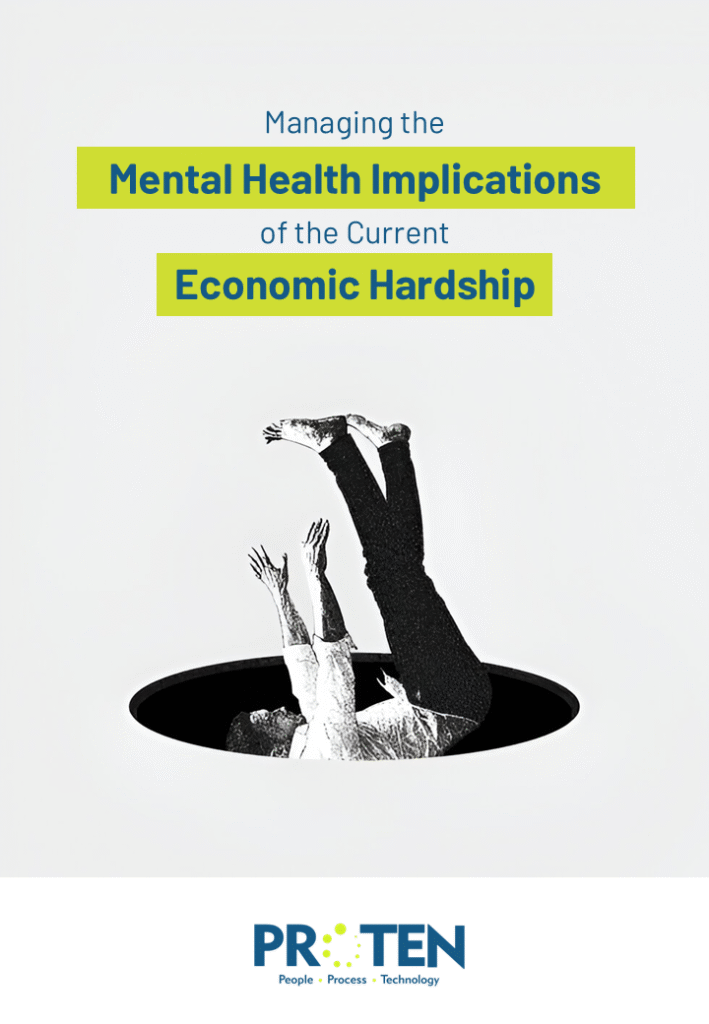

In a bid to understand the mental health implications of the current economic hardship, Proten International carried out a survey of employees. The survey revealed that 51.6% of employees in Nigeria cannot meet basic living expenses with their current income, while only 9.4% can meet their needs fully with their salary.

Source: Proten International

The financial strain caused by the unstable economic realities is a source of emotional and mental health challenges for employees. From the survey, many employees reported having their mental health negatively impacted by the sharp and consistent increase in the cost of transportation, basic needs, and utilities. There were also reports of discouragement and lack of concentration at work due to the economic hardship.

Addressing mental health challenges is not only a moral imperative but also an economic necessity. Organizations in Nigeria must take proactive steps to mitigate the adverse effects of economic hardship, ensuring a productive, healthy, and engaged workforce.

Nigeria’s Economic Context

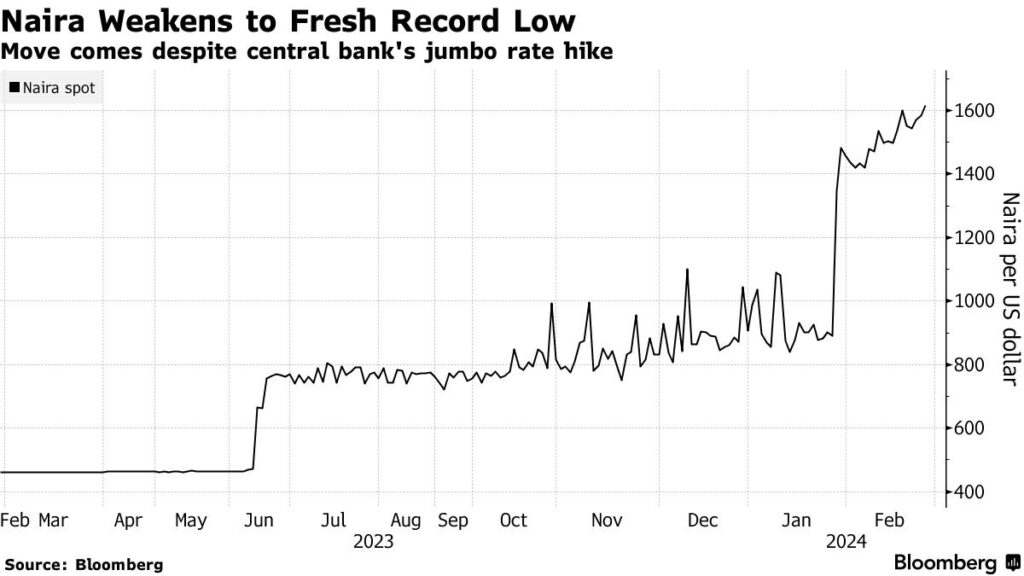

The Nigerian economy has faced significant challenges in recent years, driven by a combination of internal and external factors. The removal of fuel subsidies, devaluation of the naira, and accelerating inflation rates have drastically reduced the purchasing power of the average Nigerian. These challenges have been compounded by widespread unemployment, with many employed individuals working under precarious conditions.

This economic strain has resulted in reduced household income and limited access to essential services such as healthcare and education. For employees, the dual burden of rising living costs and stagnant wages has created an environment of chronic stress and uncertainty.

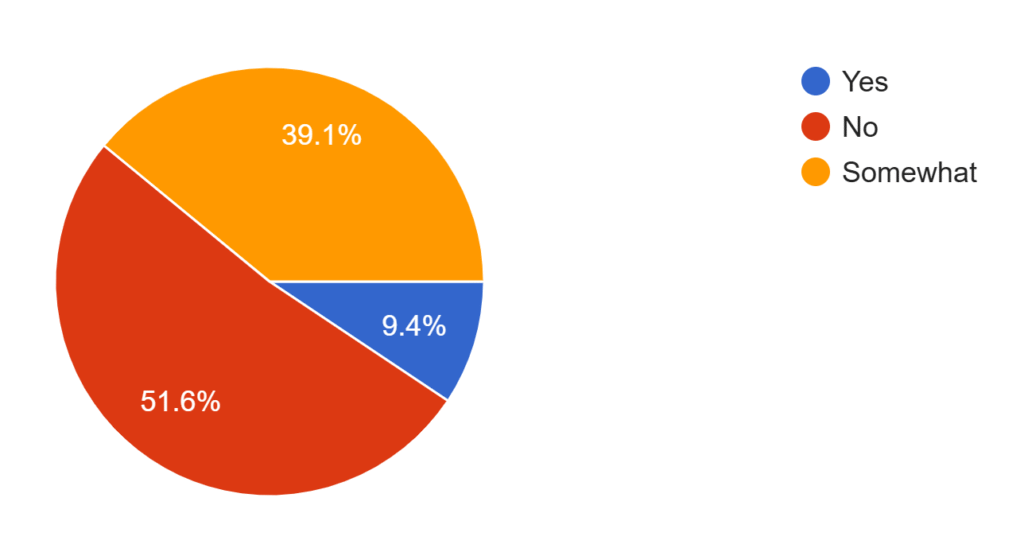

Inflation

Nigeria’s inflation rate increased for the second consecutive month in October 2024, reaching a four-month high of 33.9%, up from 32.7% in September. This surge was largely driven by escalating food prices, soaring energy costs, and continued volatility in foreign exchange markets. Food inflation, which constitutes the largest component of Nigeria’s inflation basket, accelerated to 39.2% in October, compared to 37.8% in September.

Source: NESG Research

The spike was attributed to reduced harvests caused by severe flooding and ongoing crises in critical agricultural regions. Transportation costs also saw a significant increase, with inflation climbing to 29.3%, fueled by higher petrol and gas prices following the removal of fuel subsidies. Meanwhile, housing and utilities inflation edged up to 28.8% from 28.6% in September, due to rising electricity tariffs. Core inflation, which excludes volatile agricultural and energy prices, reached a record high of 28.4%, compared to 27.4% in the prior month.

Currency Devaluation

According to a World Bank report, the Nigerian Naira has been termed one of the worst-performing currencies in Sub-Saharan Africa, with the Naira losing 82% of its value in 2024.

The current inflationary trend remains largely driven by currency depreciation, with the official exchange rate averaging N1471/US$ in June compared to N769/US$ in June 2023. The devaluation has inflicted significant losses on multiple sectors with telecommunications and manufacturing being the hardest hit.

The Mental Health Landscape in Nigeria

Source: WHO

Nigeria is facing a profound mental health crisis, with millions of citizens affected by various mental disorders. According to the World Health Organization (WHO), approximately 20% of Nigerians—about 40 million people—are grappling with mental health conditions.

Among the most common are depression and anxiety disorders, which had a significant prevalence even in 2017, with around 7 million people (3.9% of the population) experiencing depressive disorders and 4.9 million (2.7%) suffering from anxiety disorders.

Additionally, conditions such as substance abuse disorders, bipolar disorder, schizophrenia, and personality disorders are widespread. The mental health burden is further compounded by post-traumatic stress disorder (PTSD) and other trauma-related conditions, particularly among those exposed to conflict, violence, or natural disasters.

Mental illnesses profoundly affect the lives of many Nigerians, with certain professions bearing a particularly heavy burden. A study conducted by Usmanu Danfodiyo University Teaching Hospital revealed high levels of psychological distress and burnout among bankers, healthcare workers, and primary school teachers. Notably, nearly 70% of teachers reported experiencing psychological distress. In the banking sector, poor mental health among employees has significantly hindered organizational performance and growth, underscoring the far-reaching impact of psychological well-being on both individuals and institutions.

Despite these effects, many Nigerians only acknowledge mental health disorders when individuals exhibit disruptive behaviour that draws public attention. This misconception leads many to delay seeking professional help, with psychiatrists often consulted only as a last resort for patients in severe or critical conditions.

Despite Nigeria’s significant mental health burden, the country faces critical challenges in providing adequate care. One of the most pressing issues is the severe shortage of mental health professionals. With a population of over 200 million, Nigeria has only about 200 psychiatrists and 1,000 psychiatric nurses, far below the global standard of one psychiatrist per 10,000 patients. Additionally, the country suffers from a scarcity of psychologists, further limiting access to essential mental health services. This deficit has left millions without the professional support needed to address their mental health challenges effectively.

Mental Health Implications of Economic Hardship

1. Financial Stress and Anxiety

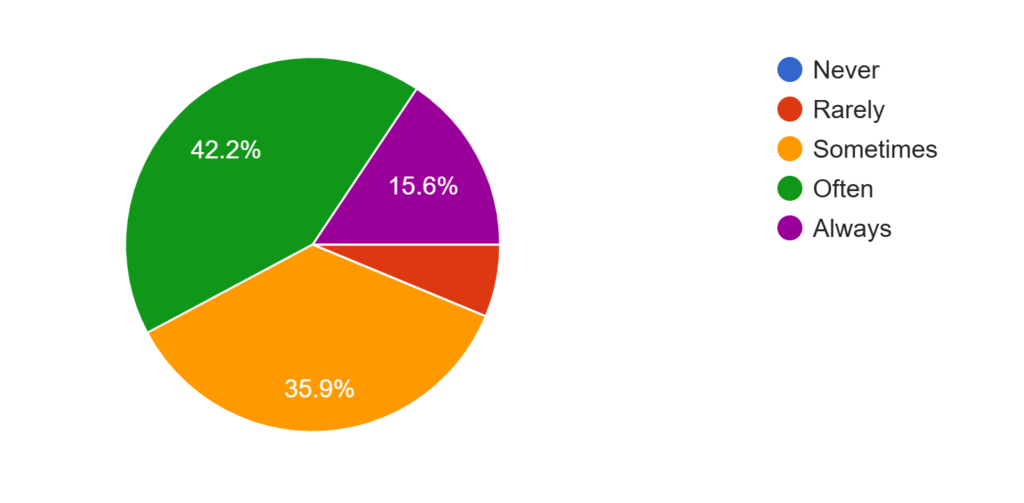

Inflation has driven up the cost of basic goods and services, making it difficult for employees to meet daily needs. According to the survey of employees’ mental health survey carried out by Proten International, 57.8% of employees surveyed said they always or often feel stressed due to financial constraints.

Source: Proten International

The current economic downturn has posed serious challenges to the mental health of employees, particularly around the areas of financial stress and anxiety.

2. Increased Prevalence of Depression

The prevalence of depression has surged as economic hardship intensifies. Financial instability, job losses, rising living costs, and the inability to meet basic needs contribute to chronic stress and feelings of hopelessness. For many, the pressure to provide for their families amidst limited resources exacerbates emotional distress, often leading to clinical depression.

Financial difficulties are a common cause of stress and anxiety. According to a survey by the Money and Mental Health Policy Institute, almost one in five (18%) of people dealing with mental health issues are in debt.

Also, financial difficulties significantly hinder recovery from common mental health conditions. Individuals with depression who are burdened by problem debt are 4.2 times more likely to remain depressed after 18 months compared to those without financial challenges. This prolonged recovery underscores the deep connection between economic strain and mental health outcomes.

3. Burnout from Overwork

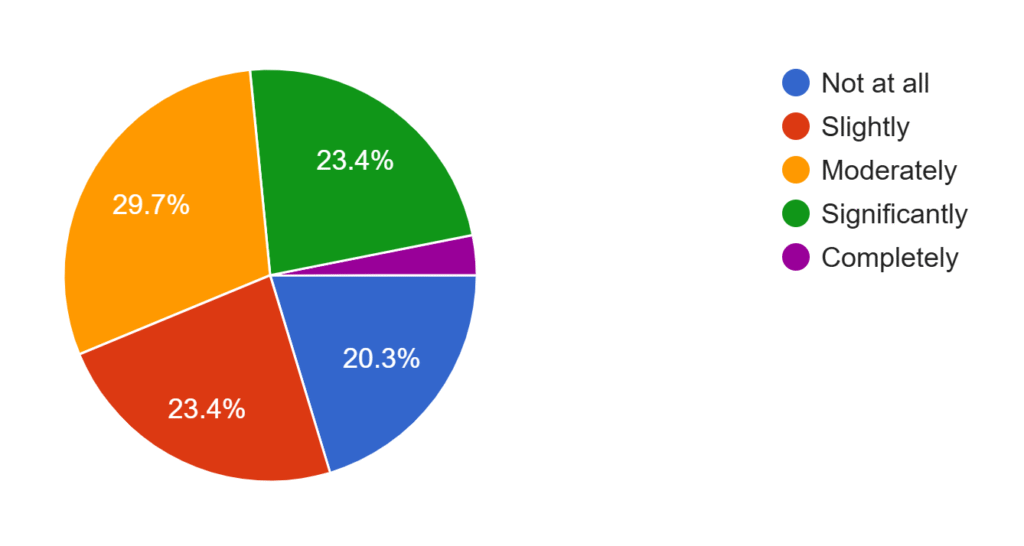

Proten International employees’ survey showed that 23.4% of employees reported their productivity at work being significantly impacted by financial stress while 29.7% reported moderate impact.

Source: Proten International

In addition to this, many organizations reduce staff during economic downturns, increasing workloads for remaining employees. Employees may feel compelled to push beyond their limits due to job insecurity or the fear of unemployment, resulting in physical exhaustion, emotional fatigue, and diminished productivity.

This chronic overextension not only erodes mental and physical health but also strains personal relationships and reduces overall quality of life, creating a vicious cycle of stress and burnout. This is especially true in Nigeria’s banking sector where employees frequently report working overtime without additional pay, leading to high burnout rates.

4. Social and Family Strain

Economic hardship places significant strain on social and family relationships, as financial stress often leads to increased conflicts and emotional tension. Families may struggle to meet basic needs, causing feelings of inadequacy and frustration among breadwinners.

The pressure to support extended family members or fulfil cultural obligations can exacerbate these challenges. Over time, these stressors can weaken family bonds, erode trust, and contribute to mental health issues, further compounding the emotional toll of financial instability.

5. Heightened Risk of Substance Abuse

Economic hardship often drives individuals to substance abuse as a coping mechanism to escape financial stress and emotional distress. Alcohol, drugs, and other substances may provide temporary relief but can lead to dependency, exacerbating financial woes and mental health challenges. The strain of unemployment, reduced income, and an uncertain future makes vulnerable individuals more likely to seek solace in substances, creating a cycle of addiction, declining health, and further socioeconomic difficulties.

Addressing Mental Health Challenges Effectively

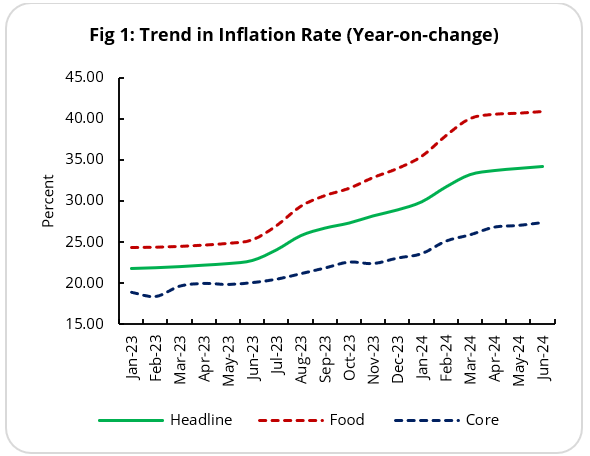

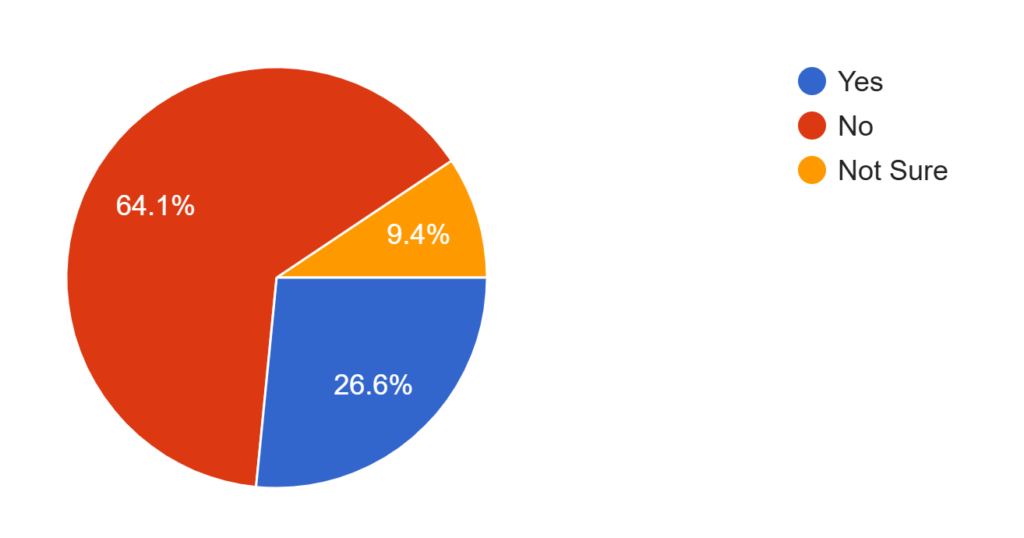

From our survey, the overwhelming majority of employees in Nigeria reported that their organisations do not provide resources for managing stress such as counselling services and financial education.

Source: Proten International

Employers in Nigeria can play a pivotal role in supporting employees through the mental health challenges brought about by the current economic hardship. Here are some useful strategies tailored to the Nigerian context:

1. Provide Access to Mental Health Services

- Partner with Local Mental Health Professionals: Collaborate with counselors, therapists, and psychologists to provide affordable or free sessions for employees.

- Employee Assistance Programs (EAPs): Establish confidential support systems offering counseling, stress management, and financial advice.

- Virtual Mental Health Solutions: Use apps like “Mentally Aware Nigeria Initiative” to give employees easy access to mental health resources.

2. Promote Financial Literacy

- Financial Planning Workshops: Offer training on budgeting, saving, and debt management to help employees cope with rising costs.

- Emergency Loan Programs: Partner with microfinance institutions to provide low-interest loans for unexpected expenses.

- Salary Advance Programs: Allow employees to access part of their salaries early to manage cash flow challenges.

3. Foster an Open and Supportive Work Environment

- Encourage Open Conversations: Create a workplace culture where employees feel safe discussing mental health without stigma or fear of discrimination.

- Establish Peer Support Groups: Facilitate employee-led forums where individuals can share experiences and coping strategies.

- Mental Health Awareness Campaigns: Conduct sessions to educate employees and managers on recognizing and addressing mental health issues.

4. Train Managers to Support Mental Health

- Recognize Warning Signs: Train managers to identify signs of stress, burnout, or depression among team members.

- Practice Empathy: Equip leaders with skills to engage empathetically with struggling employees and offer appropriate support.

- Flexible Work Policies: Allow for remote work or flexible schedules where possible to help employees manage personal and professional demands.

5. Review Workloads and Compensation

- Reassess Workload Distribution: Ensure tasks are manageable and evenly distributed to prevent burnout.

- Fair Compensation: Regularly review wages to align with inflation and consider bonuses or non-monetary incentives to boost morale.

6. Encourage Work-Life Balance

- Mandatory Breaks: Encourage employees to take regular breaks and use vacation time to recharge.

- Wellness Programs: Organize wellness activities such as yoga sessions, exercise groups, or mindfulness training.

- Social Events: Plan affordable team-building activities to foster camaraderie and reduce stress.

7. Advocate for Mental Health Policies

- Insurance Coverage: Appeal for mental health services to be included in employer-sponsored health insurance plans.

- Policy Integration: Develop workplace policies that explicitly address mental health, including provisions for causal leave to attend to mental health issues.

- Community Engagement: Partner with NGOs and advocacy groups to expand mental health resources available to employees.

8. Leverage Technology

- Mental Health Apps: Provide employees with access to apps offering stress relief, guided meditations, and telehealth counselling.

- HR Analytics: Use data-driven tools to monitor absenteeism, productivity, and other indicators that may signal mental health concerns.

9. Recognize and Reward Efforts

- Celebrate Achievements: Recognize employees’ contributions to boost morale and foster a sense of value.

- Non-Monetary Incentives: Offer perks like extra days off, skill-building opportunities, or public appreciation.

By taking these steps, organisations can significantly reduce the mental health burden on their workforce, enhancing employee resilience, morale, and productivity, even amid economic challenges.

Conclusion

Managing the mental health implications of economic hardship among employees in Nigeria is essential for building a high-performance workforce. The rising costs of living, job insecurity, and financial stress have intensified mental health challenges, including anxiety, depression, and burnout, which directly impact workplace performance and employee well-being.

Employers in Nigeria have a unique opportunity to address these challenges by fostering supportive work environments, implementing mental health-friendly policies, and providing access to affordable resources such as counselling and financial planning services.

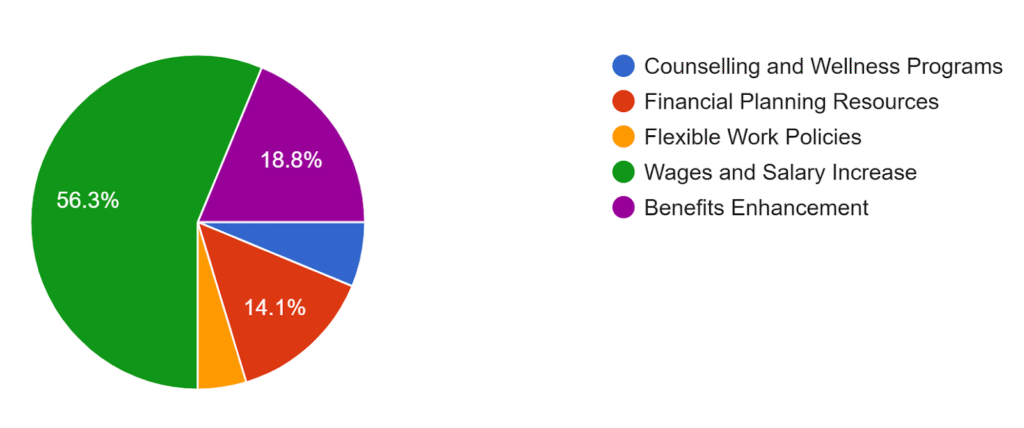

In addition to these solutions, effective compensation plans are also very vital. According to Proten International’s mental health survey, when asked what type of support would be most helpful for managing mental health challenges arising from economic hardship, 75.1% of employees opted for a salary increase or benefit enhancement.

Source: Proten International

By prioritizing employee mental health, organizations not only enhance individual well-being but also strengthen their own efficiency and performance. Investing in these measures is a critical step toward navigating Nigeria’s economic challenges while ensuring a healthier, more engaged, and productive workforce.